Will LA Consulting challenge insurer lowball offers or exclusions?

LA CONSULTING

Original Content

Yes, LA Consulting is dedicated to challenging lowball offers and wrongful exclusions from insurance companies. Insurers often undervalue claims or attempt to deny coverage for damages that should be included under your policy. Without professional representation, many property owners feel pressured to accept these unfair offers. Our team levels the playing field by carefully reviewing your policy, documenting every detail of your loss, and negotiating aggressively to ensure your insurer pays what you are rightfully owed.

Why insurers make lowball offers

Insurance companies operate as businesses, and one of their strategies for protecting profits is offering the lowest possible payout. They know that many policyholders lack the time, knowledge, or energy to fight back, especially after a stressful loss. Lowball offers are designed to minimize company liability and close claims quickly. Unfortunately, this leaves property owners struggling to fund full repairs or replace damaged contents. LA Consulting’s role is to challenge these tactics and secure fair settlements.

How exclusions are used against you

Another common tactic is citing policy exclusions to deny parts of your claim. Insurers may argue that certain damages were pre-existing, caused by wear and tear, or fall outside covered events. While exclusions do exist, they are often misapplied or exaggerated by company adjusters. At LA Consulting, we review the fine print and identify coverage provisions that counter these denial attempts. By interpreting policy language in your favor, we make a compelling case for including disputed damages.

We also use case law and regulatory guidance when necessary to strengthen our position.

Our negotiation process

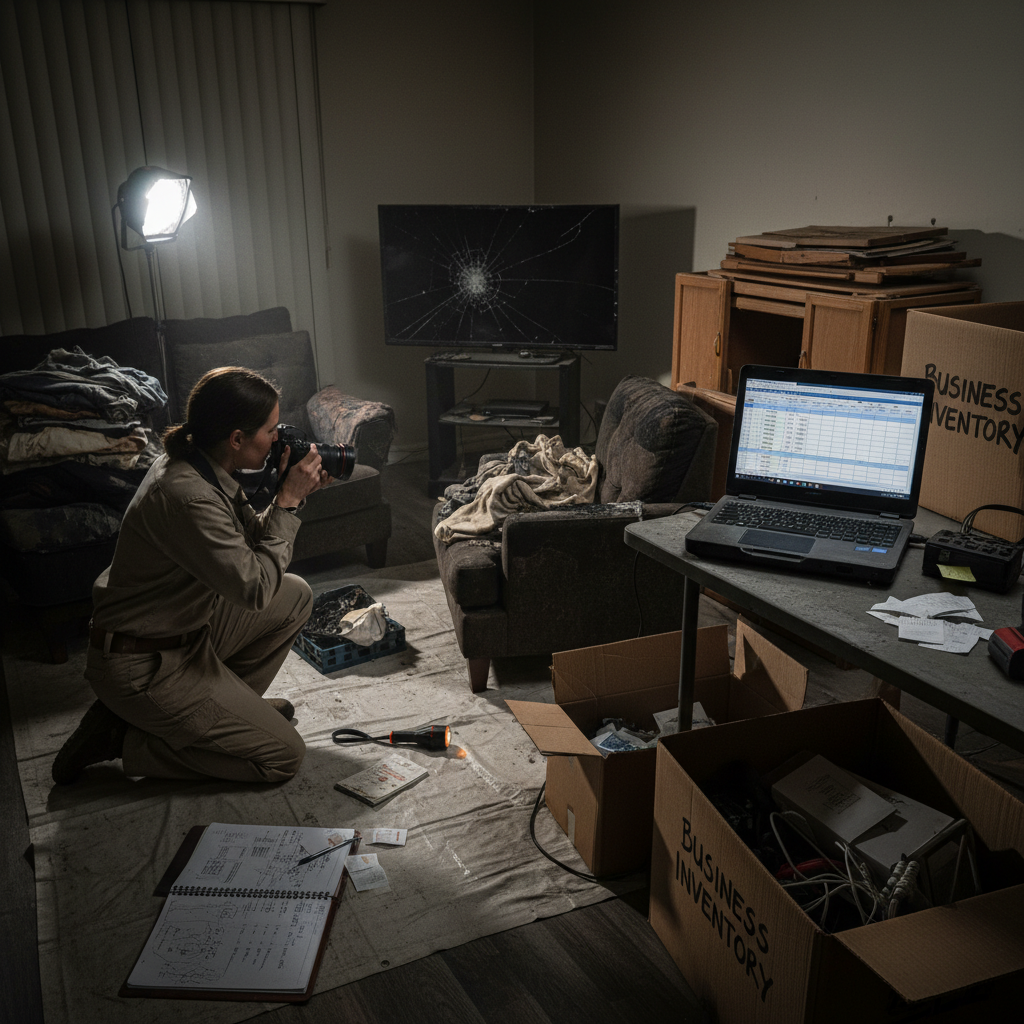

When faced with a lowball offer or questionable exclusion, we present the insurer with a complete claim package that includes photographs, estimates, expert reports, and policy analysis. This leaves little room for insurers to justify underpayment. Our adjusters are trained negotiators who understand the tactics insurers use and know how to counter them effectively. If needed, we escalate disputes to appraisal or mediation to ensure your rights are protected.

This process often results in dramatic increases from initial offers.

Real outcomes for clients

We have helped homeowners and businesses turn denials or small offers into life-changing settlements. For instance, one client offered $8,000 for water damage ultimately received $38,000 after our intervention. Another business client denied for roof damage recovered over $200,000 once we proved the damage was storm-related and not wear and tear as the insurer claimed. These results highlight why it is essential not to accept an insurer’s first response without expert review.

Our record of challenging unfair practices speaks for itself.

The bottom line

Yes, LA Consulting will challenge lowball offers and unfair exclusions. Our job is to hold insurers accountable and ensure you receive the full benefits promised under your policy. By combining documentation, policy expertise, and aggressive negotiation, we consistently turn inadequate offers into fair settlements. When you work with us, you do not have to settle for less than you deserve.