Can You File an Insurance Claim in Florida After Missing the Deadline?

File Insurance Claim Florida Missed Deadline assistance for Florida homeowners and business owners - LA Consulting Public Adjusters offers these services to help property owners maximize their claims.

Summary

- Possibly, exceptions and tolling may apply

- Act fast to preserve evidence and rights

- LA Consulting evaluates and pursues late claims

Missing an initial insurance deadline in Florida does not always mean your claim is lost. Deadlines depend on your policy, state statutes, and the specific facts of your loss. Exceptions such as discovery rules, tolling, insurer waiver, or emergency declarations can reopen or extend filing windows. LA Consulting Public Adjusters reviews timelines, documents, and damage to identify valid pathways for recovery and to maximize your settlement.

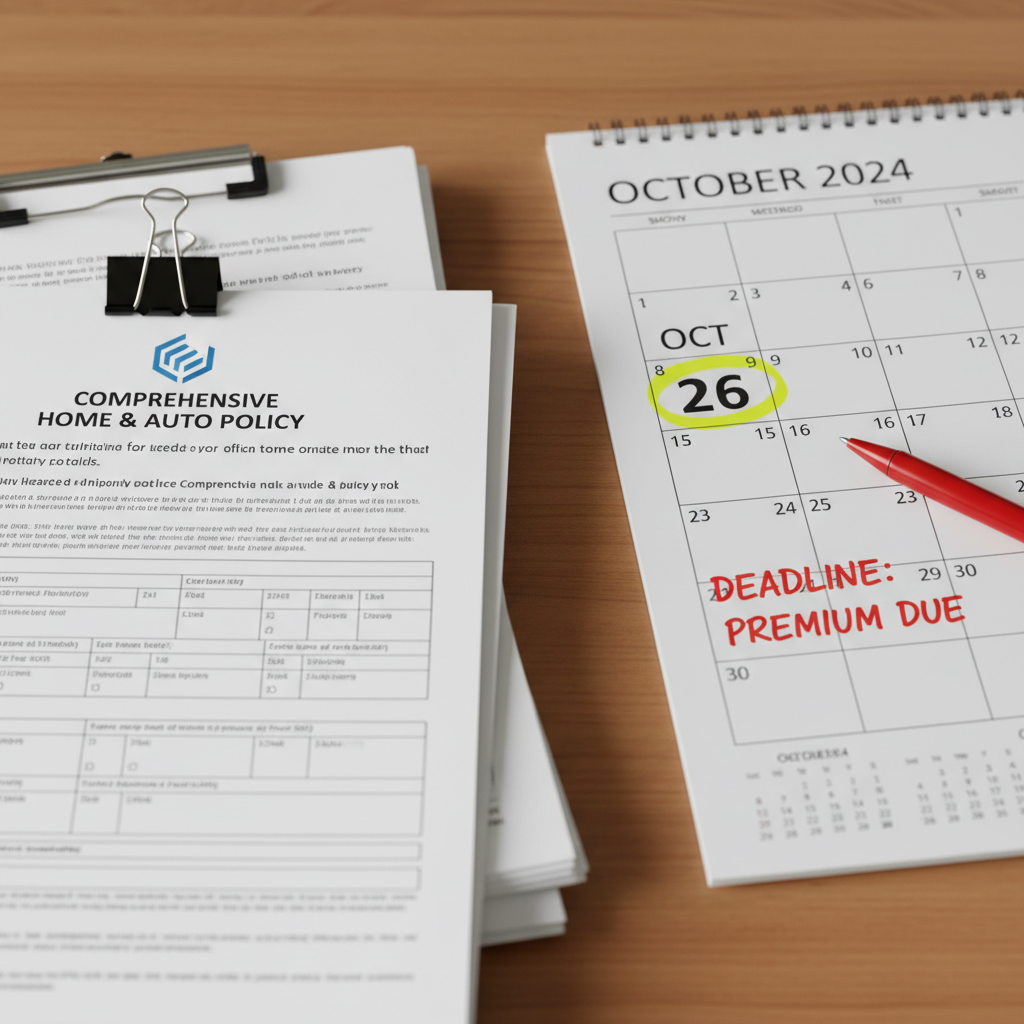

Why Deadlines Matter

Deadlines protect insurer and policyholder rights. Prompt notice allows insurers to investigate, preserve evidence, and complete repairs. Missing deadlines can lead to denials or legal barriers, but courts and regulators may allow late filings when prejudice to the insurer is absent or when legal tolling applies. Proper documentation, mitigation, and a professional timeline reconstruction are essential.

Can You Still File After the Deadline?

Yes, in many cases. Common legal doctrines that help late filers include the discovery rule, equitable tolling, estoppel, and insurer waiver. Emergency orders after hurricanes or declared disasters can also extend claim windows. Success depends on facts: when damage was discovered, when you gave notice, insurer actions, and policy language. LA Consulting analyzes these elements to determine viable claim strategies.

We focus on evidence: photos, repair invoices, communications, contractor reports, and expert assessments. Our licensed adjusters document causation and loss scope, reconstruct timelines, and prepare demand packages that address insurer prejudice concerns. We negotiate directly with insurers and coordinate with restoration professionals to support your position without relying on price quotes alone.

How LA Consulting Helps

LA Consulting Public Adjusters offers licensed, local expertise across Florida, with experience handling hurricane and water intrusion claims. We assess coverage, estimate repairs using industry-standard software, and prepare forensic documentation to substantiate late claims. Our team negotiates aggressively to maximize recoveries while explaining legal options and potential hurdles.

Our process includes an immediate review of your insurance policy and loss notice history, evidence preservation guidance, timeline reconstruction, and a documented claim submission or appeal. When needed we coordinate with attorneys for litigation support, craft demand letters, and seek extensions or equitable remedies that can revive a late claim.

Common Exceptions and Legal Tools

Discovery rule: time starts when damage is reasonably discovered. Equitable tolling: deadlines paused for compelling reasons. Estoppel: insurer conduct prevented timely filing. Emergency declarations: post-disaster extensions. Payment or partial coverage can also affect timing. Each exception has specific criteria; a fact-by-fact analysis is critical.

When exceptions apply, claimants can recover full policy benefits, including repairs, contents replacement, and additional living expenses where covered. LA Consulting leverages experience to identify applicable exceptions, build evidence, and negotiate higher settlements than unrepresented claimants typically receive.

Next Steps If You Missed the Deadline

Immediately gather all policy documents, photos, repair estimates, correspondence, and payment records. Preserve damaged property and document ongoing damage. Have a licensed public adjuster review your timeline and documents to assess exceptions and possible extensions. A prompt, professional evaluation increases the chance to reopen a claim or pursue alternative remedies.