Is Roof Replacement Covered by My Insurance Policy in Florida? What Property Owners Should Know

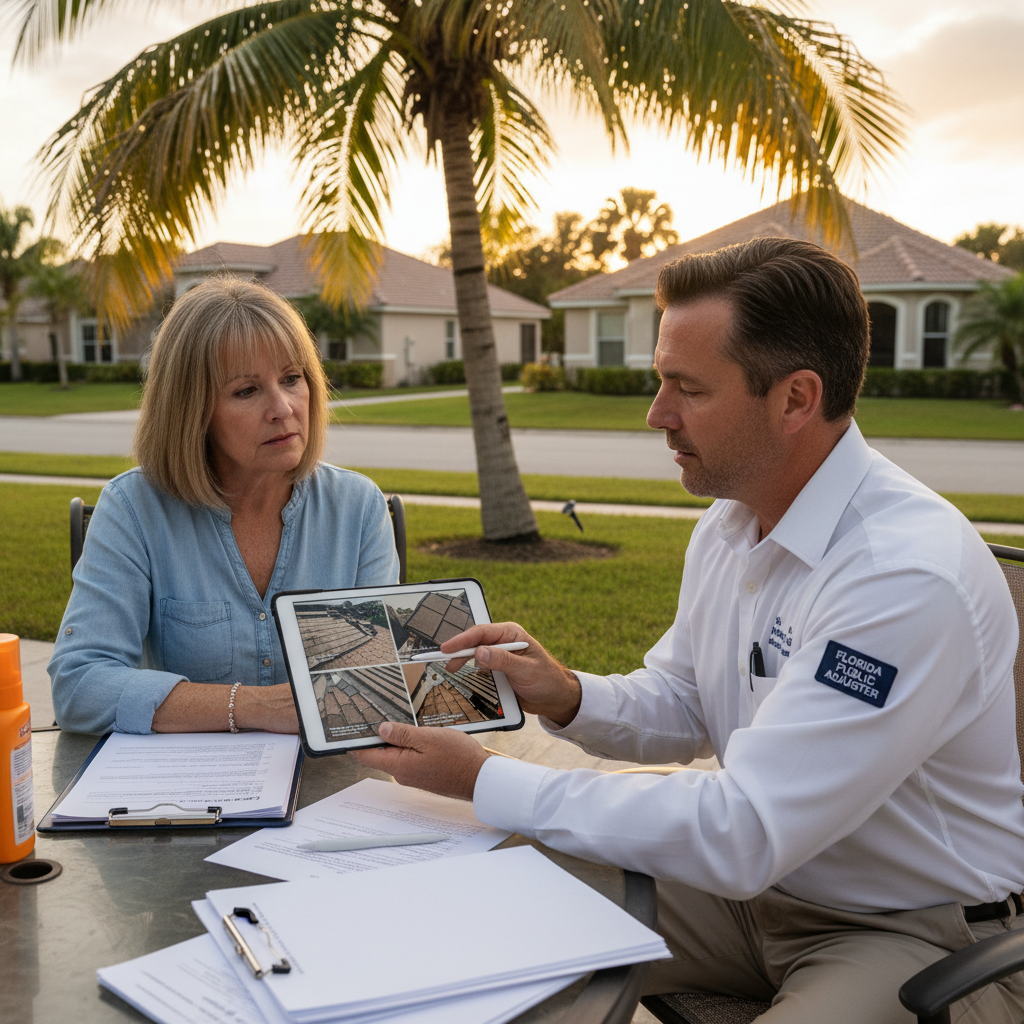

Roof replacement insurance policy Florida claim assistance for homeowners and businesses. LA Consulting Public Adjusters offers roof replacement insurance policy Florida services to help property owners maximize their claims through licensed adjusters, detailed estimates, and negotiated settlements.

Summary

- Coverage depends on your policy terms

- ACV vs RCV affects replacement payments

- LA Consulting helps maximize roof claims

If your roof was damaged in Florida storms you are likely asking if roof replacement is included in your policy. Coverage varies by policy language, cause of damage, and the age and condition of your roof. LA Consulting Public Adjusters helps you determine whether your policy covers a full roof replacement, documents loss with professional evidence, prepares industry standard estimates, and negotiates with insurers to pursue the full recovery your property needs.

How Roof Coverage Works in Florida

Insurance policies commonly pay Actual Cash Value (ACV) or Replacement Cost Value (RCV). ACV factors depreciation and may pay less for older roofs; RCV pays to replace like kind and quality after depreciation is recovered. Policies may include exclusions for wear and tear, lack of maintenance, or specific perils. Florida policies often contain hurricane or windstorm deductibles and may offer ordinance and law coverage to address code upgrade costs when a full replacement is required.

Common Coverage Scenarios

Storm events such as wind, hail, or falling debris are often covered if the policy lists those perils and you can prove causation. Gradual deterioration, improper maintenance, and preexisting conditions are typically excluded. Hidden damage like decking rot, underlayment failure, or water intrusion may be covered if tied to a covered event and properly documented.

Insurers sometimes limit payments to repair or offer ACV settlements when they dispute replacement. You can challenge scope, depreciation, and exclusions with supporting evidence including contractor estimates, infrared imaging, moisture testing, and roof certifications. LA Consulting compiles professional scope reports and Xactimate-quality estimates and pursues supplements when insurers miss damage or code upgrade needs.

How a Public Adjuster Helps

A licensed public adjuster from LA Consulting reviews your policy, inspects the roof, documents damage with measurements and photos, obtains detailed estimates, and delivers a professional claim package to the insurer. We identify hidden damage, negotiate recoverable depreciation, pursue ordinance and law claims, handle supplements and appeals, and coordinate with local contractors to maximize your settlement while ensuring compliance with policy terms.

After damage occurs you should mitigate further loss, take timestamped photos and videos, keep receipts for emergency repairs, and file a claim promptly. Avoid signing final releases or assignment agreements without expert review. Contacting a public adjuster early preserves evidence, strengthens proof of causation, and improves the likelihood of a full replacement award when merited by the loss.

What Evidence Insurers Look For

Insurers evaluate cause of loss, scope, roof age, maintenance history, and contractor estimates. They look for proof linking damage to a covered peril such as storm photos, neighborhood reports, roofing invoices, moisture scans, and certified inspection reports. Professional documentation increases credibility and settlement value, especially for hidden or progressive damage.

A claim typically involves adjuster inspection, scope negotiation, and a settlement offer. Disputes can be addressed with supplements, appraisal, mediation, or other remedies. Timelines and policy deadlines matter; review your policy for filing timeframes and seek an adjuster to ensure you meet insurer requirements and preserve appeal options.

Maximizing Your Roof Replacement Settlement

Maximize recovery by hiring a licensed public adjuster, documenting all visible and hidden damage, obtaining multiple detailed estimates, and pursuing code upgrade and ordinance claims when applicable. LA Consulting leverages local Florida knowledge, proven negotiation strategies, and industry estimating tools to identify missed line items, document causation, and negotiate higher settlements. We use contingency-based and value-driven methodologies to align incentives and focus on maximizing your claim rather than fixed fees.