Will You Review My Policy? Florida Hurricane Damages Covered Explained

Review Policy Florida Hurricane Damages Covered for residential and commercial properties in Florida including roof, wind, water intrusion, and contents claims. LA Consulting Public Adjusters offers these services to help property owners maximize their claims by performing expert policy analysis, damage scoping, documentation, and negotiated settlements.

Summary

- Identify hurricane perils covered

- Distinguish wind versus flood damage

- Maximize settlement with licensed adjusters

When you ask "Will you review my policy to explain exactly what hurricane damages are covered?" you deserve a clear, expert answer tailored to Florida rules and common carrier practices. LA Consulting Public Adjusters performs a line-by-line policy review to identify covered perils, exclusions, endorsements, deductibles, and limits that matter in a hurricane claim. Hurricanes produce multiple damage mechanisms including direct wind damage, wind-driven rain and water intrusion, storm surge and flood, and secondary issues such as mold or structural failure. Coverage can vary by policy type, endorsements, and local building code requirements. Our licensed adjusters combine forensic documentation, code knowledge, and claims experience to translate complex policy language into practical coverage determinations so you know what your insurer should pay.

What Hurricane Damages Insurance Typically Covers in Florida

Typical covered hurricane damages include wind damage to roofing, gutters, soffits, siding, and structural framing; wind-driven rain that enters through a compromised envelope; impact damage from flying debris; breakage of windows and doors; collapse from covered perils; contents damage caused by covered perils; temporary repairs and tarping; debris removal when related to a covered loss; and additional living expenses when the dwelling is uninhabitable. Some policies also include ordinance and law coverage for code upgrades required to repair or rebuild to current standards. Coverage scope depends on your declarations page, covered perils form, and specific endorsements or limitations.

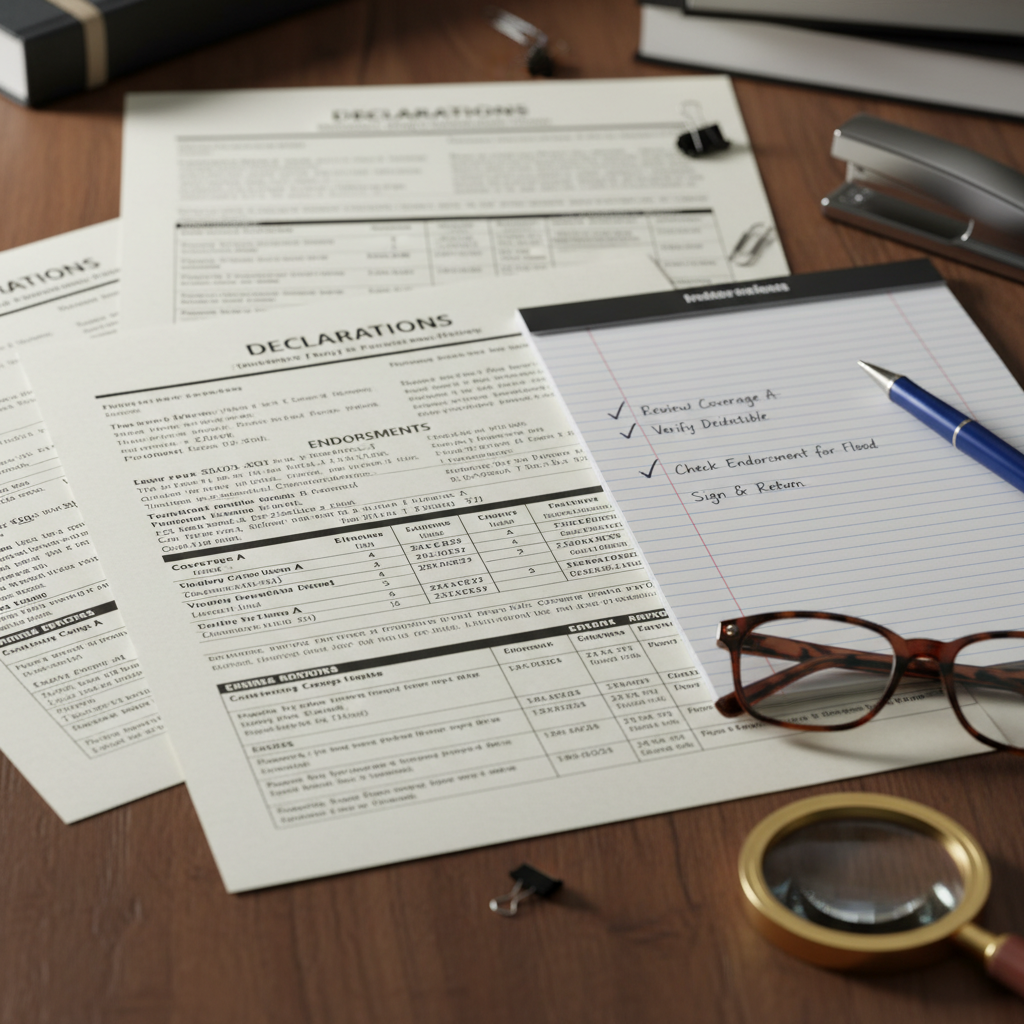

Common Exclusions and Where to Look in Your Policy

Common exclusions include flood and storm surge unless you have flood insurance, wear and tear or maintenance-related damage, preexisting conditions, and certain mold or water seepage not tied to a covered peril. Look for flood, water exclusion language, maintenance clauses, and sublimits for windstorm or hurricane named peril. Endorsements can add or remove coverage and may alter deductibles or valuation methods such as actual cash value versus replacement cost.

Hurricane and windstorm deductibles are often percentage-based in Florida and may apply differently than standard deductibles. Some policies impose a separate hurricane deductible for named storms, which applies to the building limit before any other deductible. Understanding how and when each deductible applies is critical to evaluating a claim and determining potential recovery.

How LA Consulting Reviews Your Policy and Builds Your Claim

Our process begins with a thorough policy analysis that isolates declarations, endorsements, and exclusions. We then perform an on-site damage assessment, document observed loss with photos and measurements, and prepare a detailed scope of damage and estimate. We identify recoverable items including building, contents, temporary repairs, debris removal, code upgrades, and business interruption when applicable. LA Consulting leverages licensed adjusters, construction estimators, and engineering partners to build a comprehensive demand that challenges low initial offers and pursues supplements when hidden damage emerges.

To maximize settlements we use proven methodologies: timely documentation, indexed photographic evidence, independent estimates tied to industry pricing guides, building code documentation, and a documented chain of repairs and costs. We manage depreciation and recoverable depreciation when supported by your policy. We also pursue coverage for code upgrades and mitigation measures where applicable. We do not quote fixed fees in text; instead our approach focuses on transparent evaluation methods and strategies to preserve and enhance claim value.

Key Documents and Evidence We Use

Essential materials include the declarations page, all policy forms and endorsements, pre-loss photos, post-loss photos and video, repair estimates, contractor invoices, building permits, receipts for temporary repairs, proof of loss statements, weather and storm reports, and any prior claims history. These items frame coverage, prove timing and cause, and substantiate the scope and cost of repairs.

Expect a structured timeline for review and claim management. Initial policy review and scope summary can be delivered quickly. Documentation and supplemental scope development follow onsite inspection. Insurer response windows, appraisal, mediation, or litigation timelines vary by carrier and policy. LA Consulting guides the procedural steps and documents persuasive claim packages to meet carrier requirements and, if necessary, support appraisal or dispute resolution.

Next Steps If You Want a Policy Review

A professional policy review yields a clear written analysis of what hurricane damages are likely covered, what exclusions or endorsements may limit recovery, and an action plan to document and present your claim. LA Consulting Public Adjusters performs this analysis for Florida homeowners and commercial property owners, identifies coverage opportunities such as wind-driven rain, temporary repairs, ordinance upgrades, and unseen damage, and prepares the documentation needed to pursue full recovery on your claim.