(239)771-9741

Can You Speed Up the Insurance Company's Response in Florida?

Speed Up Insurance Company's Response Florida for residential and commercial claims. LA Consulting Public Adjusters offers speed up insurance company's response Florida services to help property owners maximize their claims.

Summary

- Document damage immediately and thoroughly

- Use a licensed public adjuster to push insurers

- Leverage statutory timelines and demand letters

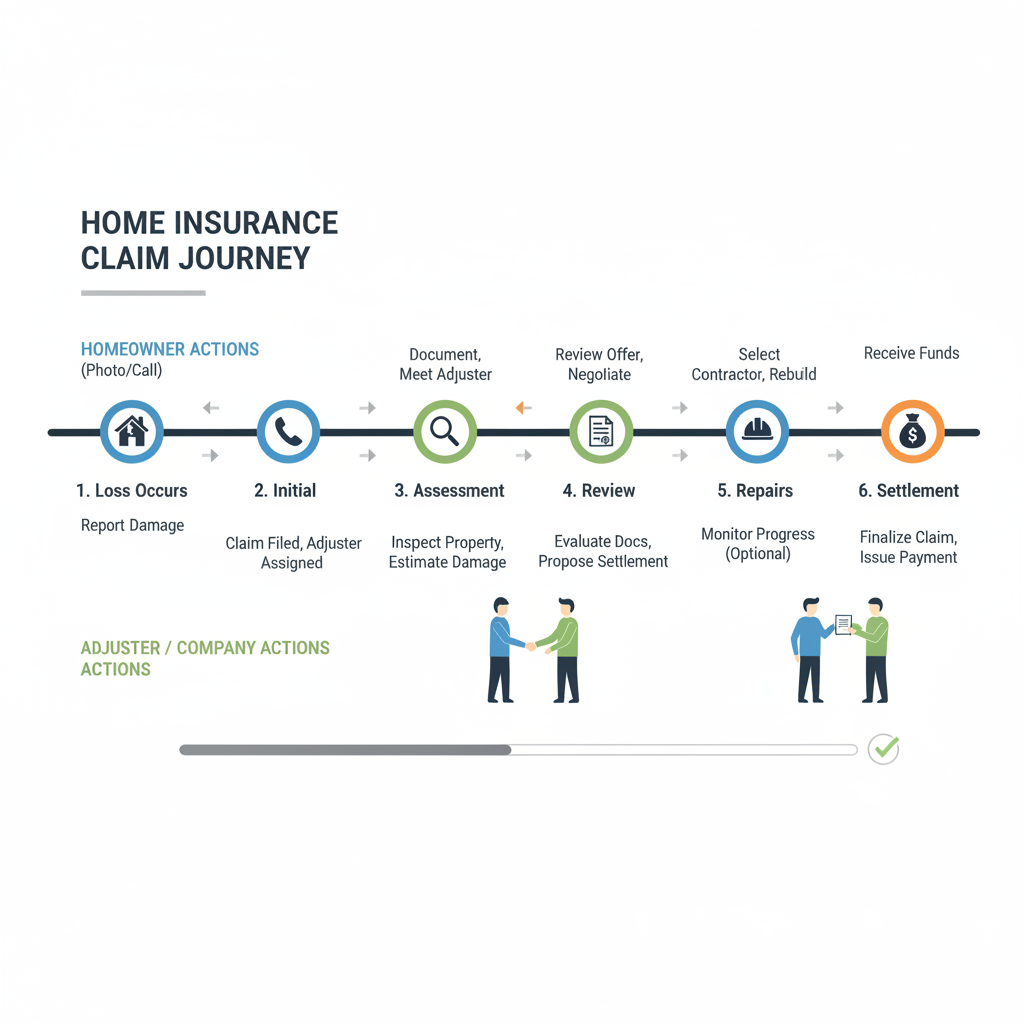

When your property is damaged you need a timely insurance response. While you cannot force an insurer to act instantly you can significantly accelerate their process by following proven steps and using a licensed public adjuster. LA Consulting Public Adjusters in Florida specializes in speeding up insurance company responses while protecting your claim and maximizing settlement value.

How Insurer Response Times Affect Your Claim

Slow responses can increase damage, raise mitigation costs, and weaken evidence. The longer an insurer delays the harder it can be to document preexisting conditions versus new damage. Prompt acknowledgements and decisions preserve your bargaining position and improve the chances of a full recovery.

Proven Steps to Accelerate an Insurance Response

Start by documenting everything: timestamped photos, videos, contractor estimates, emergency mitigation receipts, and a detailed inventory. File your claim and proof of loss quickly and follow the insurer's preferred submission channels. Track every communication and request written confirmations for phone calls.

LA Consulting steps in when homeowners need faster action. Our licensed adjusters prepare professional scope of loss reports, Xactimate style estimates, repair contractor coordination, and formal demand packages that prioritize urgent issues. We manage insurer follow ups, submit supplements, and push for timely acknowledgements and decisions to protect your claim value.

Legal Tools and Florida Timelines

Florida law and regulatory expectations create enforceable timelines insurers must meet. Knowing how to frame a demand, when to request an appraisal, and when to file a regulatory complaint can move a slow claim forward. Public adjusters use these tools strategically to create accountability.

LA Consulting leverages local knowledge of Florida insurers and regulatory processes to enforce timelines and escalate claims. We document compliance failures, prepare formal demand letters, and communicate with claims teams and oversight bodies to encourage timely action without compromising your settlement.

Documentation That Forces Quicker Responses

Insurers respond faster to clear, organized evidence. Use a clear photo log, annotated diagrams, contractor scopes, invoices, and certified loss estimates. Immediate mitigation with receipts and before/after photos is essential to show priority and limit further loss.

A licensed public adjuster compiles evidence into a compelling, insurer ready package that leaves little ambiguity. LA Consulting's reports emphasize causation, scope, and cost, reducing back and forth and prompting faster insurer review and payment.

Why Choose LA Consulting Public Adjusters

You benefit from licensed local adjusters, detailed forensic documentation, and a proven negotiation process designed to accelerate insurer responses and maximize recoveries. LA Consulting has a track record of resolving complex Florida claims efficiently. We prioritize your property and your claim while protecting your rights and settlement potential.