(239)771-9741

How LA Consulting Public Adjusters Handles Roof Depreciation Claims in Florida

We offer roof depreciation claims representation and recovery services for Roof Depreciation Claims Florida, including storm-damaged shingle and tile roofs; we handle depreciation disputes, RCV recovery, supplemental claims, and appraisal advocacy

Summary

- Insurers apply depreciation to older roofs

- Public adjusters can challenge and recover depreciation

- Document, invoice, appeal, or request appraisal

If your insurer is trying to depreciate your roof, you may be facing a large reduction in your payout. LA Consulting Public Adjusters in Florida specializes in challenging insurer depreciation practices by combining policy expertise, on-site inspections, contractor estimates, and documented evidence to pursue full replacement value rather than reduced actual cash value.

Why insurers depreciate roofs and what it means

Insurers commonly apply depreciation to older roofs to calculate Actual Cash Value (ACV), reducing payments based on age and expected life. Depreciation reflects wear and tear in the insurer calculation and can significantly lower your recovery unless you can qualify for Recoverable Depreciation or Replacement Cost Value (RCV) under your policy.

How LA Consulting challenges depreciation calculations

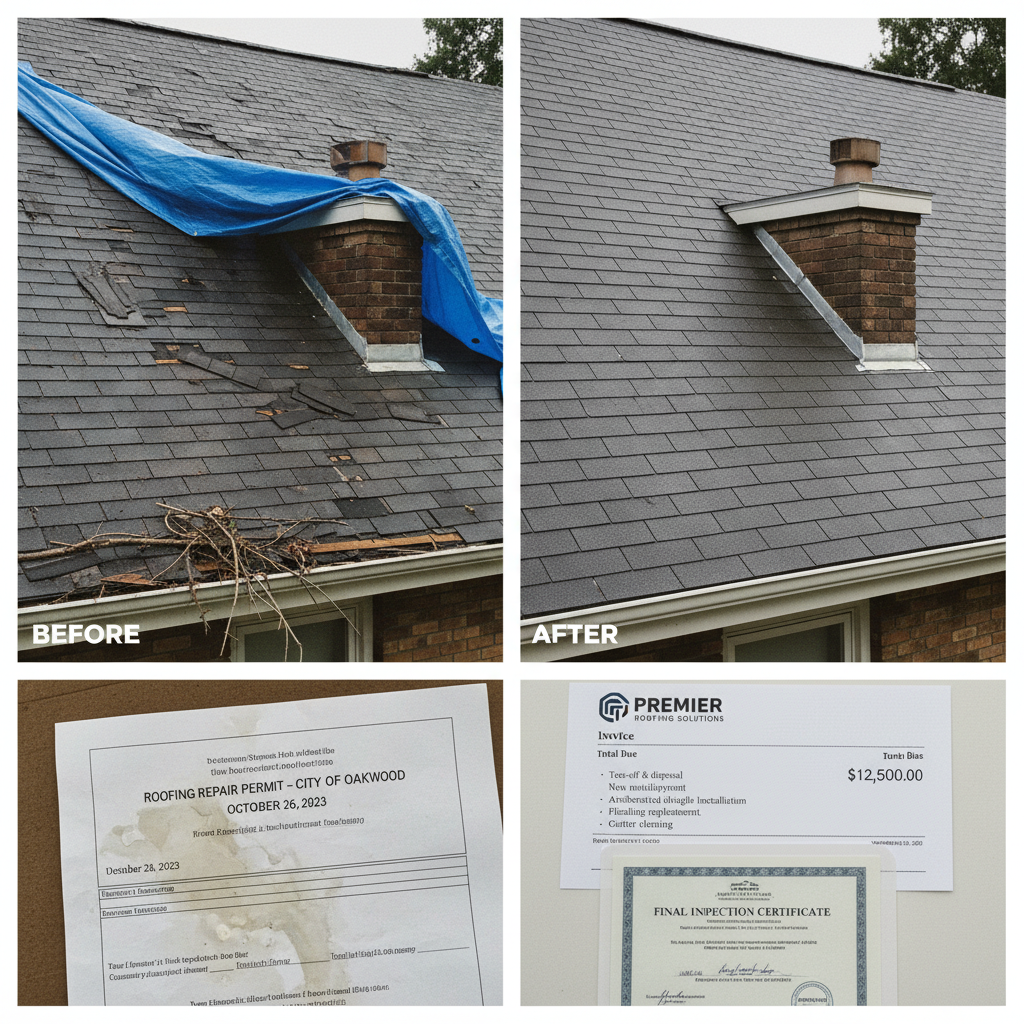

We analyze your policy, review depreciation schedules, and document pre-loss condition and storm damage with high-resolution photos, roof scans, and contractor reports. We assemble evidence to dispute improper age-based or erroneous depreciation factors and to prove that damage, not age, caused the loss.

We also pursue supplemental recoverable depreciation by submitting final invoices, proof of repairs, and code upgrade documentation. When insurers deny recoverable depreciation or understate loss, we escalate through demand letters, reinspection requests, and appraisal or mediation when necessary.

Step-by-step actions you should take immediately

Preserve evidence: photograph all roof damage, keep pre-loss maintenance records and any original installation or permit documents. Obtain a licensed contractor estimate to document scope and cost. Log all communications with the insurer and save adjuster reports.

Submit timely documentation to the insurer: contractor invoices, photographs, and permit evidence. If the insurer pays ACV with depreciation withheld, provide final repair invoices to demand the recoverable depreciation RCV check. If they refuse, document the refusal in writing for escalation.

Negotiation tactics, supplements, and the appraisal option

We prepare a detailed settlement strategy showing correct useful life, local Florida climate impacts on roof materials, and matching and code upgrade costs. We negotiate using independent replacement estimates, storm severity documentation, and comparative pricing to rebut insurer depreciation tables.

If negotiations stall, we pursue formal dispute resolution, including appraisal or appraisal demand per the policy. Our adjusters prepare a concise appraisal brief showing how depreciation was misapplied and provide expert testimony to the umpire when needed.

Why choose LA Consulting Public Adjusters

As Florida-licensed public adjusters, we bring experience with local building codes, storm patterns, and insurer depreciation methods. We emphasize accurate documentation, fast supplemental recovery, and transparent reporting so your claim maximizes eligible replacement value. Our focus is on proven claim resolution strategies and accountable representation.